Written by Allen Wyatt (last updated June 29, 2019)

This tip applies to Excel 97, 2000, 2002, and 2003

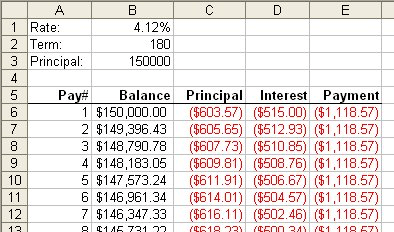

Mary would like to use Excel to create an amortization schedule for her home mortgage. Problem is, she doesn't know enough about finance to know which of the financial worksheet functions she should use to do the calculations.

It actually is fairly easy to come up with the right calculations. At its simplest, a mortgage payment consists of two parts: principle and interest. Given some basic information such as how much you are borrowing (your principal), what your interest rate is, and how many monthly payments you need to make, you can then come up with your amortization schedule. Try this out:

Figure 1. A simple amortization schedule.

Remember that I said that this creates a simple amortization schedule. It doesn't take into account varying interest rates, refinancing, non-monthly payments, additional payments, escrow amounts, or any number of other variables. In such instances you would be better to look for a ready-made amortization template. There are any number of them available online, including these from Microsoft:

http://office.microsoft.com/en-us/templates/TC001056620.aspx

You can also find a very good explanation of amortization schedules at this page:

http://www.tvmcalcs.com/calculators/apps/excel_loan_amortization

ExcelTips is your source for cost-effective Microsoft Excel training. This tip (11627) applies to Microsoft Excel 97, 2000, 2002, and 2003.

Program Successfully in Excel! This guide will provide you with all the information you need to automate any task in Excel and save time and effort. Learn how to extend Excel's functionality with VBA to create solutions not possible with the standard features. Includes latest information for Excel 2024 and Microsoft 365. Check out Mastering Excel VBA Programming today!

Excel allows you to enter two different types of formulas in a cell: A regular formula or an array formula. If you need ...

Discover MoreNeed to know the directory (folder) in which a workbook was saved? You can create a formula that will return this ...

Discover MoreWhen working with text phrases stored in cells, it might be helpful to be able to extract words from the phrase. In this ...

Discover MoreFREE SERVICE: Get tips like this every week in ExcelTips, a free productivity newsletter. Enter your address and click "Subscribe."

There are currently no comments for this tip. (Be the first to leave your comment—just use the simple form above!)

Got a version of Excel that uses the menu interface (Excel 97, Excel 2000, Excel 2002, or Excel 2003)? This site is for you! If you use a later version of Excel, visit our ExcelTips site focusing on the ribbon interface.

FREE SERVICE: Get tips like this every week in ExcelTips, a free productivity newsletter. Enter your address and click "Subscribe."

Copyright © 2026 Sharon Parq Associates, Inc.

Comments