Written by Allen Wyatt (last updated June 29, 2019)

This tip applies to Excel 97, 2000, 2002, and 2003

Mary would like to use Excel to create an amortization schedule for her home mortgage. Problem is, she doesn't know enough about finance to know which of the financial worksheet functions she should use to do the calculations.

It actually is fairly easy to come up with the right calculations. At its simplest, a mortgage payment consists of two parts: principle and interest. Given some basic information such as how much you are borrowing (your principal), what your interest rate is, and how many monthly payments you need to make, you can then come up with your amortization schedule. Try this out:

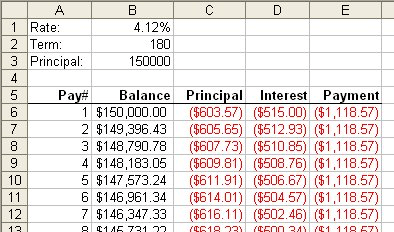

Figure 1. A simple amortization schedule.

Remember that I said that this creates a simple amortization schedule. It doesn't take into account varying interest rates, refinancing, non-monthly payments, additional payments, escrow amounts, or any number of other variables. In such instances you would be better to look for a ready-made amortization template. There are any number of them available online, including these from Microsoft:

http://office.microsoft.com/en-us/templates/TC001056620.aspx

You can also find a very good explanation of amortization schedules at this page:

http://www.tvmcalcs.com/calculators/apps/excel_loan_amortization

ExcelTips is your source for cost-effective Microsoft Excel training. This tip (11627) applies to Microsoft Excel 97, 2000, 2002, and 2003.

Excel Smarts for Beginners! Featuring the friendly and trusted For Dummies style, this popular guide shows beginners how to get up and running with Excel while also helping more experienced users get comfortable with the newest features. Check out Excel 2019 For Dummies today!

Need to figure out the lowest score in a range of scores? Here's the formulas to get the information you need.

Discover MoreWhen editing information in a cell, you may need to know the result of a portion of your formula. The shortcut described ...

Discover MoreIf you need to generate a random sequence of characters, of a fixed length, then you'll appreciate the discussion in this ...

Discover MoreFREE SERVICE: Get tips like this every week in ExcelTips, a free productivity newsletter. Enter your address and click "Subscribe."

There are currently no comments for this tip. (Be the first to leave your comment—just use the simple form above!)

Got a version of Excel that uses the menu interface (Excel 97, Excel 2000, Excel 2002, or Excel 2003)? This site is for you! If you use a later version of Excel, visit our ExcelTips site focusing on the ribbon interface.

FREE SERVICE: Get tips like this every week in ExcelTips, a free productivity newsletter. Enter your address and click "Subscribe."

Copyright © 2026 Sharon Parq Associates, Inc.

Comments